Price: $8.89

(as of Oct 09, 2024 05:17:22 UTC – Details)

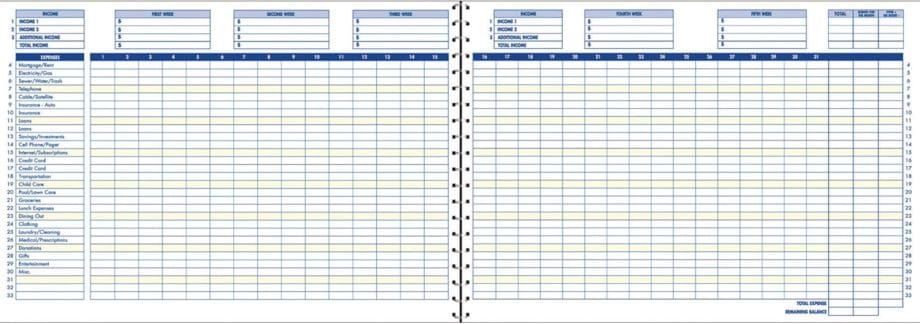

This undated money planner is 5.82×8.25 inch, inludes 12 months of financial planning with structured pages for setting financial goals, financial strategy, savings, debts, daily expense, monthly budget, monthly budget review, Christmas budget, summary of the year sections, which is a good finance books, it will help you to take control of your money effectively.

This undated budget planner contains:

- 1 financial goals page

- 1 financial strategy page

- 4 saving tracker pages

- 4 debt tracker pages

- 12 months budget planner pages(10 pages per month, 1 unique color for each month).

- 2 Christmas budgeting pages,

- 2 yearly summary pages

- 12 notes pages(colleague ruled)

This monthly budget planner features high quality 100gsm white paper for easy writing and reducing ink leakage, erase fraying and shade issues, providing clean writing space for your goals, plans and reminders. Sturdy and flexible covers to protect the inner pages well, thick paper for smooth writing, strong twin-wire binding, sturdy plastic pocket to store loose items, like tickets, cards, papers etc, elastic cloure to protect your planner, all these details demonstrate high quality. This planner is available in 2 different colors, teal and rose.

This 12 month budget planner organizer helps you to set monthly goals, budget, review, and develop monthly habits, monetary strategies & action plans. Write down your monthly financial goals, put reminders of bills and payments on the calendar. Use monthly budget section to plan your monthly budget in each expense categories. Track your daily expenses during the month. Review monthly budget at the end of month, reflect on your accomplishments and think about how to do better next month.

MANAGE YOUR MONEY EFFECTIVELY – This budget planner contains financial goals, financial strategy, savings, debts, daily expense, monthly budget, monthly budget review, Christmas budget, summary of the year sections, which is a good finance books, it will help you to take control of your money effectively

MONTHLY GOALS & BUDGET & REVIEW ORGANIZED – 12 month budget planner helps you to set monthly goals, budget, review, and develop monthly habits, monetary strategies & action plans well. Write down monthly financial goals, put reminders of bills & payments on the calendar. Monthly budget section to plan your monthly budget in each categories. Track daily expenses during the month. Review monthly budget at the end of month, reflect on your accomplishments and think about how to improve next month

UNDATED & 1 YEAR USE – Undated finance books start with 1 page for financial goals, 1 page for financial strategy, 4 pages for saving tracker, 4 pages for debt tracker, followed by 12 months(10 pages per month, 1 unique color for each month). 2 pages for Christmas budgeting, 2 pages for yearly summary and 12 pages for notes(colleague ruled). It is undated, so you could start at any time, suitable for 1 year use

PREMIUM QUALITY – A5 budget planner with 100gsm paper to reduce ink leakage, erase fraying and shade issues. Sturdy and flexible cover, elastic closure to protect the inner pages well. Strong metal and lay-flat twin-wire binding. Inner pocket to store loose items, like bills, receipts etc. User manual with filled examples for quick start. One colorful trapezoid on each edge of planner, 12 colorful trapezoid represent 12 months. Easy to track by colorful trapezoid on side view

GURANTEED SATISFACTION – We gurantee this money planner could manage your financial effectively

Customers say

Customers like the trackability, value for money, and ease of use of the planner. They mention it has all the necessary pages to track savings, bills, calendars, and note pages. Some appreciate the simple but flexible setup and instructions on how to best use the book. Others say the quality is well-made and sturdy. Customers also like the size, saying it’s perfect for carrying in their purses.

AI-generated from the text of customer reviews

4.5

Reviewer: Guy and Brandy

Rating: 5.0 out of 5 stars

Title: ð°ð Budget Planner & Monthly Bill Organizer: Your Financial Compass! ðð°

Review: In a world where financial control is the path to freedom, the Budget Planner & Monthly Bill Organizer emerges as your trusted compass for navigating the complex landscape of money management. This is more than just a planner; it’s your roadmap to financial success!ð Effective Money Management: The Budget Planner is a comprehensive finance book, offering financial goals, strategies, savings, debt tracking, daily expenses, monthly budgeting, monthly budget reviews, Christmas budgeting, and a yearly summary. It’s your personal finance guru, guiding you to take control of your money effectively.ðï¸ Monthly Goals & Budgets: With 12 months of planning, this organizer helps you set monthly goals, budgets, and develop winning financial habits. Write down your financial aspirations, mark bill reminders on the calendar, allocate funds to various categories, and meticulously track daily expenses. At the end of each month, review your progress, celebrate accomplishments, and plan for even greater financial success.ð

Undated & 1-Year Use: The undated format means you can start anytime, ensuring it’s suitable for a full year’s use. It begins with sections for financial goals, strategies, savings, and debts. Then, each month offers 10 pages for comprehensive planning, with a unique color for each month. Additionally, there are sections for Christmas budgeting, yearly summaries, and ample note-taking space.ð Premium Quality: This budget planner is designed for excellence. Its 8″x9.5″ size offers ample writing space, and the 100gsm paper reduces ink leakage, fraying, and shading issues. The sturdy and flexible PU leather cover protects your financial secrets, and the elastic closure ensures the inner pages remain secure. The strong metal and lay-flat twin-wire binding make it easy to write comfortably, and an inner pocket is provided for loose items like bills and receipts. The included user manual with filled examples ensures a quick start, and the colorful trapezoids on the edges represent the 12 months, making tracking a breeze.In a world where financial success is a journey, the Budget Planner & Monthly Bill Organizer is your trusty companion. It empowers you to take charge of your finances, set and achieve your goals, and ultimately, find financial freedom. Start your journey today! ð°ðºï¸ð

Reviewer: Joni Fisk

Rating: 5.0 out of 5 stars

Title: Easy to use

Review: If youâre looking for a way to get started with budgeting and saving this is a great book for it. Iâve been using it everyday and I love it. I track my spending and my saving. I love the options it gives you for savings and goals and things.

Reviewer: Kunle

Rating: 5.0 out of 5 stars

Title: Perfect Budget Planner for Beginners

Review: I recently started using this budget planner, and I’m really impressed with its quality and functionality. It’s very user-friendly and compact, making it easy to carry in my purse wherever I go. Despite its small size, it provides plenty of space to track all my budgeting details month by month. I particularly like that it offers ample space to track expenses, allowing me to stay on top of my finances effortlessly. It also provides a monthly undated calendar, which allows you to start using the planner any time. The planner is sturdy and well-made, which adds to its durability. Overall, I highly recommend this budget planner to anyone looking for an effective and easy-to-use tool to manage their finances.

Reviewer: Amazon Customer

Rating: 4.0 out of 5 stars

Title: Nice Planner!

Review: This planner is simple and sufficient for basic budgeting needs.

Reviewer: Rare customer

Rating: 5.0 out of 5 stars

Title: Just what I need

Review: I struggle with budgeting and often track my bills on random pieces of paper. I love having everything in one place to track my income, savings, bills, create a budget and then track daily expenses. A simple but great tool to help with basic personal finance needs. I bought one last year and just bought another one for the next year.

Reviewer: amber pundt

Rating: 5.0 out of 5 stars

Title: Quality budget book

Review: Good value for the price. Small enough to fit in purse. Not bulky.

Reviewer: D. Smith

Rating: 3.0 out of 5 stars

Title: Budget Planner

Review: Cute; Average ( better than basic), Good Value. My dislike was categories could have been better organized…as is would rate B-….but if the organization doesn’t bother you….it would be OK. Binding is Excellent however for the cost. Would Repurchase if I could not find better one. Great for 1st time budgeting however.R.S.

Reviewer: River

Rating: 5.0 out of 5 stars

Title: Just Perfect

Review: I needed to get my budget in order. I watch my bank account everyday and had planned ahead, BUT never had much accountability. This planner helps me see EXACTLY where my money is going. Yes, it is some work and you need to keep up with it BUT if you want to save, watch your money this is your planner. I have used this for 2 months and am making a positive headway already. I will be buy another to start out 2025.

Reviewer: craig milton

Rating: 5.0 out of 5 stars

Title:

Review: WE love this thing. In the past we never kept out finances straight at all and always skimming by check to check. Now we are able to see our expenses and cut off extra spending and have been able to put money into our savings. Worth it!

Reviewer: LAURA SOTO

Rating: 5.0 out of 5 stars

Title:

Review: Excelente presentacion, de buena calidad, buena clasificacion y facil. Me encanto ya que solo el Kakebo que utilice anteriormente me confundia al llevar mi reguistros por lo que desisite de usarlo. Con este planificador es facil.

Reviewer: Joanne84

Rating: 5.0 out of 5 stars

Title:

Review: It’s a great book plenty of pages to work out your budgets only down fall I did kind of expect there be a calender in there but that’s my bad not there’s. Worth the price.

Reviewer: tatiana78

Rating: 5.0 out of 5 stars

Title:

Review: Great design and fast delivery. A little larger than the one I had last year so I can write exactly for what I spent the money. Love it

Reviewer: Emilie

Rating: 5.0 out of 5 stars

Title:

Review: Simple et efficace, ce cahier permet de savoir où nous en sommes au quotidien.

Budget Planner – Monthly Finance Organizer with Expense Tracker

Managing your finances can sometimes feel like a daunting task. However, with a reliable Budget Planner and Monthly Finance Organizer, you can easily keep your expenses in check and reach your financial goals. In this article, we’ll explore how a budget planner can transform your financial journey and offer tips to get you started.

What is a Budget Planner?

A budget planner is a tool designed to help you monitor your income and expenses over a specific period, typically monthly. It helps you visualize where your money is going, enabling you to make informed financial decisions. Whether you’re saving for a vacation, paying off debt, or planning for retirement, an effective budget planner can help streamline your finances.

Key Features of a Monthly Finance Organizer

If you’re considering using a monthly finance organizer, here are some key features to look for:

-

Expense Tracking: A good budget planner should allow you to list all your monthly expenses, making it easier to identify spending patterns and areas where you can cut back.

-

Income Overview: Keep track of all your income sources, whether it’s a salary, freelance work, or passive income streams. This helps ensure you have a clear picture of your financial standing.

-

Savings Goals: Set and track savings goals within your planner. Whether it’s for an emergency fund, a new car, or a vacation, having a designated savings section will motivate you to reach those targets.

-

Financial Reports: Look for planners that generate easy-to-understand reports, providing insights into your spending habits over time. These reports can guide you on where to adjust your budget for better financial health.

- User-Friendly Interface: A visually appealing and intuitive design can enhance your budgeting experience, making it more enjoyable and less tedious.

How to Use a Budget Planner Effectively

Now that we’ve established what a budget planner is, let’s discuss how to use it effectively:

Step 1: Gather Your Financial Information

Start by collecting information about your income and expenses. This includes bank statements, pay stubs, bills, and any other financial documents.

Step 2: List Your Income and Expenses

Using your planner, create a comprehensive list of your income and fixed expenses (like rent, utilities, and loan payments). Then, add variable expenses, such as groceries, entertainment, and personal care.

Step 3: Categorize Your Spending

Organize your expenses into categories to easily identify areas where you tend to overspend. Categories may include housing, transportation, food, entertainment, and savings.

Step 4: Set a Budget

Set realistic spending limits for each category based on your income. Be mindful of your financial goals and adjust categories accordingly to ensure you’re on track.

Step 5: Monitor Your Progress

Regularly check your spending throughout the month. This will help you stay accountable and make necessary adjustments before the month ends.

Step 6: Review and Adjust

At the end of the month, review your spending and see how well you stuck to your budget. Adjust your budget for the next month based on what you learned and any changes in your income or expenses.

Benefits of Using a Budget Planner

Incorporating a budget planner into your financial routine comes with numerous benefits:

- Financial Awareness: You become more aware of your spending habits, leading to better financial choices.

- Reducing Financial Stress: With a clear plan in place, you can alleviate worries about unexpected expenses or debt.

- Goal Achievement: Tracking your progress towards financial goals can be incredibly motivating, pushing you closer to achieving them.

Conclusion

A budget planner is a powerful tool for anyone looking to take control of their finances. By organizing your monthly finances and tracking your expenses, you can make sound financial decisions that align with your goals. Start your budgeting journey today and pave the way for a secure financial future!

Watch this video on Budget Planning Tips!

When it comes to your financial health, taking the first step by utilizing a budget planner can make all the difference. Embrace the process, be patient with yourself, and soon, you’ll be on your way to financial freedom!